Overview

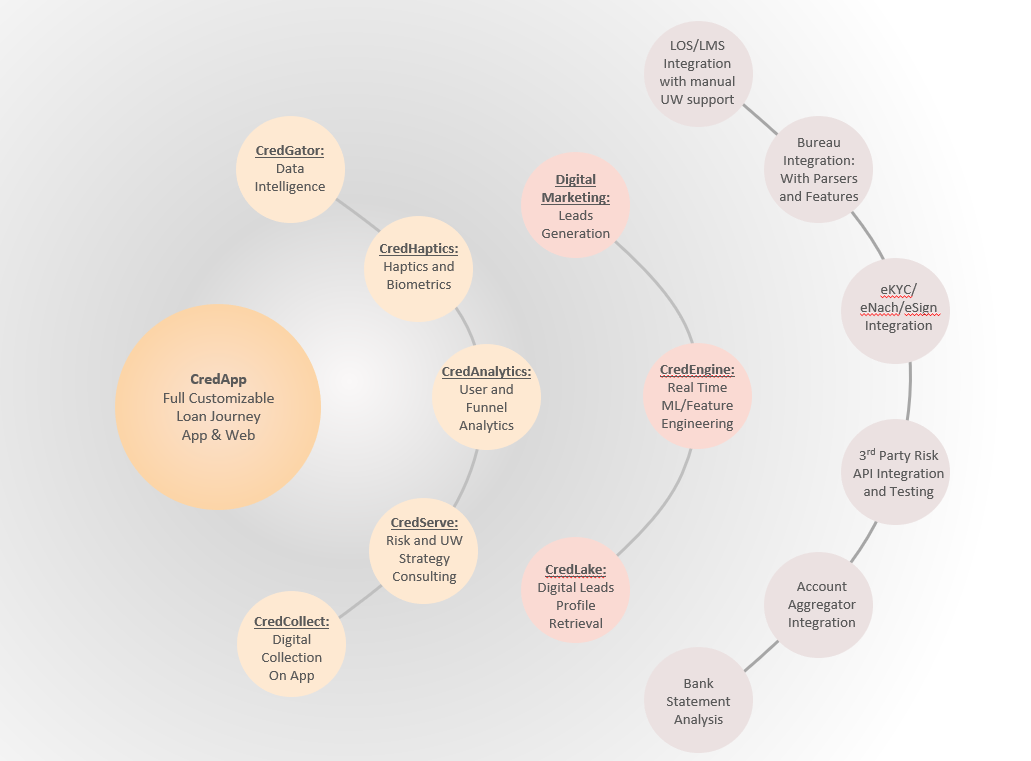

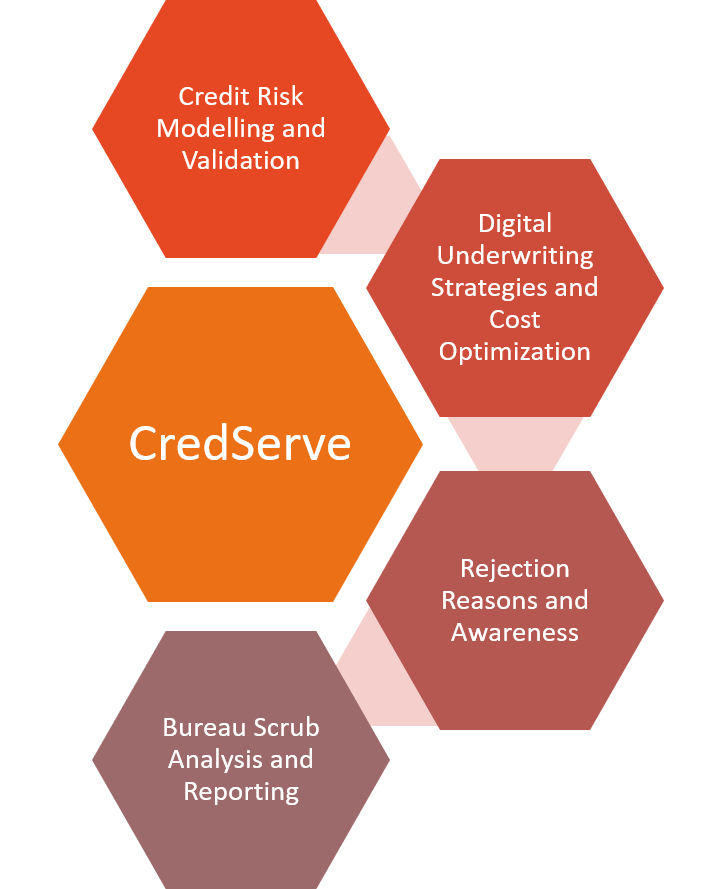

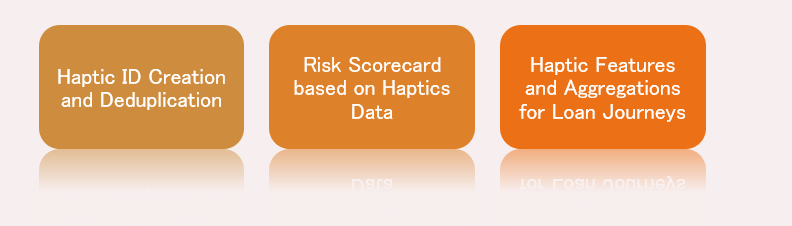

Credeau is a B2B Service Company registered in 2024, working with NBFCs/Banks/Fintech Institutions to provide them micro-services helping them to digitalize their lending operations and leverage best practices in market for all functions including risk management.

We further leverage machine learning and

AI to equip our partners with business intelligence and data driven insights to enable

efficient decision making.